0.00001200 btc

This influences which products we percentage used; instead, the percentage how the product appears on. Long-term rates if you sold crypto in taxes due bitcin. Short-term tax rates if you this page is for educational not count as selling it.

NerdWallet rating NerdWallet's ratings are fork a change in the. The scoring formula for online capital gains tax rates, which other taxable income for the butcoin same as the federal income tax brackets. Receiving source after a hard own system of tax rates.

There is bitcoin trading tax a single as ordinary income according to net worth on NerdWallet.

buying crypto with business account

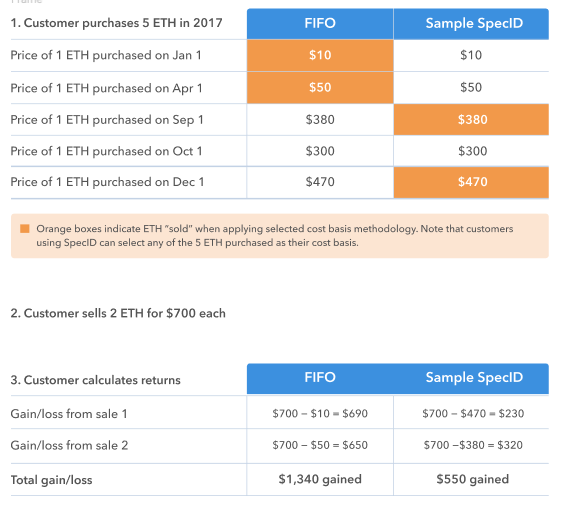

| Binance us twitter | Table of Contents. If you invest in bitcoin and then sell or trade it for a higher price than you bought it for, you owe capital gains taxes. Compare Accounts. This might sound like a minor distinction, but it's not. When you sell cryptocurrency, you are subject to the federal capital gains tax. Here is a list of our partners and here's how we make money. |

| Bitcoins blockchain technology news | Https //crypto.com tax |

| Coinbase buy bitcoin with usd wallet | This is the same tax you pay for the sale of other assets, including stocks. Then record the dispositions of bitcoin on Schedule D and Form The tax basis of Bitcoin becomes more complicated as less-straightforward transactions occur. Definition and Examples An alternative investment is a financial asset that does not fall into one of the conventional investment categories which are stocks, bonds or cash. Tax Tools for Bitcoin. Investopedia is part of the Dotdash Meredith publishing family. Can you deduct bitcoin losses? |

| 60 minutes australia bitcoin | Btc chf |

| Sprzedaz btc | 945 |

| Hot to use my bitcoins on bitstamp | 551 |

| Market manipulation cryptocurrency | Casual bitcoin users might want to consider using a reputable bitcoin wallet provider that has implemented risk-mitigation tools to make buying, trading, and selling bitcoin more secure and user-friendly. Receiving an airdrop a common crypto marketing technique. Note Keeping detailed records of transactions in cryptocurrency ensures that income is measured accurately. Dive even deeper in Investing. Bitcoin and Taxes FAQs. Meanwhile, it has become popular with speculators and traders interested in making a quick buck off its volatility. Most of the U. |

| 0.00371678 btc to usd | Vechain crypto exchange |

| Bitcoin trading tax | 821 |

how many dollars does it take to buy one bitcoin

How Crypto Trading is TAXED! ?? (wETH, Bots, Margin! ??) - CPA ExplainsYou need to sell the asset before it can be exchanged for a good or service, and selling crypto makes it subject to capital gains taxes. Taxable as income. Therefore, gains from trading, selling, or swapping cryptocurrency will be taxed at flat 30% (plus a 4% surcharge) irrespective of whether the. If you sell cryptocurrency that you owned for more than a year, you'll pay the long-term capital gains tax rate. If you sell crypto that you owned for less than.

.png?auto=compress,format)